Long-term Investment Strategy

The allocation of investments to different asset classes such as stocks, bonds, precious metals and real estate is crucial for risk and return characteristics in various economic and political developments.

The Partisan is making every effort to minimize the risk of large losses, even under extraordinary circumstances – as far as possible. For risk-free investments do not exist. In an era of negative interest rates and inflation risks this is not even the case with cash accounts.

The Partisan works with systematic scenario analyses. The focus is always on long-term expected returns and risk. The Partisan does not engage in short-term or speculative transactions. For a central lesson of finance is: fluctuations of securities prices normally cannot be predicted reliably enough to make profits in a systematic way.

True Diversification

Financial crisis 2008, Ukraine 2014, Islamic State, oil price collaps 2014/15, Brexit 2016: key developments are often anticipated by no one. In a world of constant surprises diversification provides the most effective protection against large financial losses.

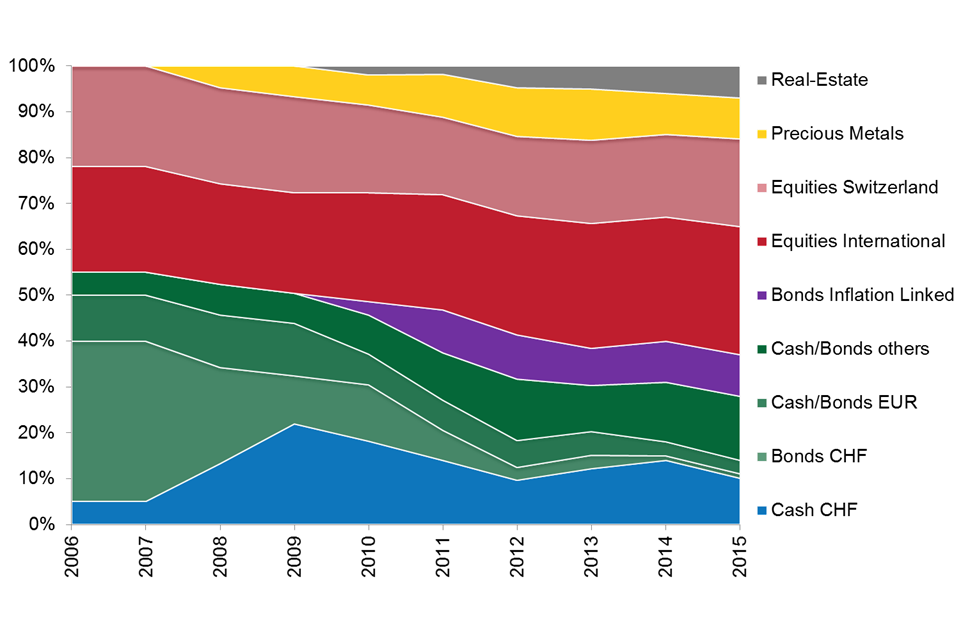

True diversification means avoiding bulk risks. New concentration risks can emerge spontaneously. For example, by increasing interdependence of European banks and governments in the wake of the Euro crisis. Therefore, good diversification requires an ongoing assessment of economic and political developments, their effects on financial risks and appropriate adjustments to the portfolio structure. This could mean to continuously strengthen investment into real assets such as stocks, precious metals and real estate instead of nominal bonds. Bonds have been increasingly threatened by negative interest rates and inflation risk in the wake of the unconventional monetary policy since the financial crisis.

Costs and Taxes

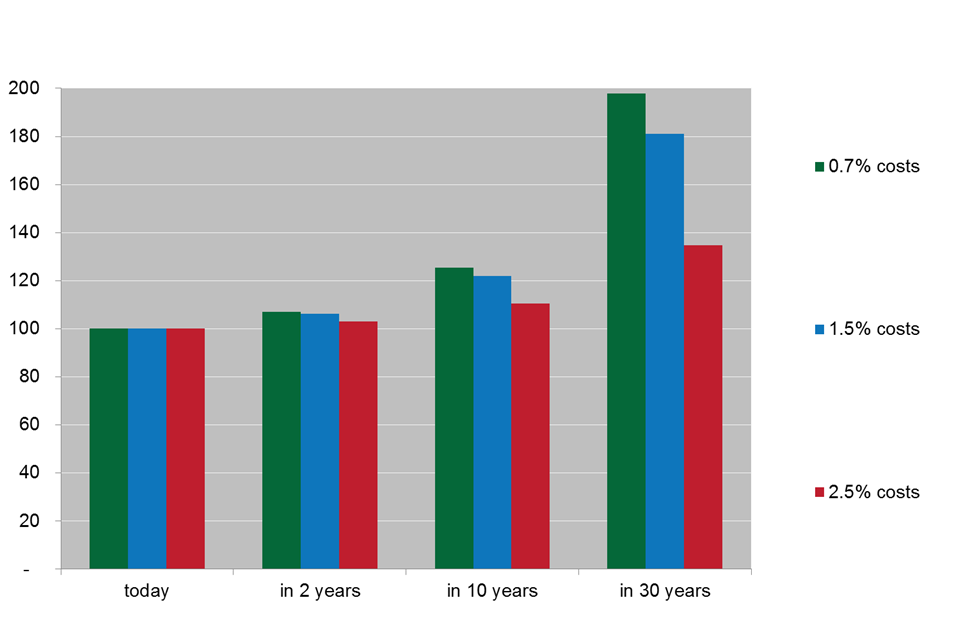

With a flat management fee of 0.5% and the systematic consideration of tax effects when selecting investments, the Partisan sets new standards: for costs and taxes erode your wealth over time very significantly, though hardly noticed. The graph shows the effect of costs over a longer period of time (assumed rate of return before expenses: 3% pa)

No Conflicts of Interest

The Partisan avoids conflicts of interest and gives highest priority to independence and transparency. For conflicts of interest are closely linked to (hidden) costs and risks: the use of proprietary products within a fund or a discretionary mandate, trailer fees or commissions can tempt asset managers not to act in the sole interest of investors.

Keep it Simple and Liquid

The Partisan is familiar with all types of financial instruments due to his education and years of experience. And their risks. Precisely for this reason he does not invest in complex derivatives, hedge funds and illiquid assets.

Skin in the Game

The Partisan holds a substantial part of his personal assets in the fund. This prevents him from taking careless decisions and unnecessary risks.